The word Customer Acquisition Cost (CAC) can strike fear into the heart of any business owner.

Here's the shocker: A survey reveals businesses waste up to a quarter of their own sales and marketing expenses and budget on ineffective customer acquisition strategies.

Is CAC a silent killer silently draining your profits, or can it be a powerful tool for growth?

This blog cuts through the confusion of what customer acquisition cost is all about. We'll show you how to calculate, analyse, and improve it to maximize your return on investment (ROI).

What is customer acquisition cost (CAC)?

Customer Acquisition Cost (CAC) is a metric that tells a business how much it costs to acquire a new customer.

It considers all the expenses involved in marketing, sales, and other efforts that bring in new customers.

The total cost of sales should generally include things like advertising costs incurred, the salary of your marketers, the costs of your salespeople, etc., divided by the number of customers acquired.

The main purpose of understanding customer acquisition cost is to assess how efficient your customer acquisition efforts are. calculate customer acquisition cost.

Ideally, you want your customer acquisition cost (CAC) to be lower than your customers' Customer Lifetime Value (LTV).

LTV is the total revenue a customer is expected to bring over their business relationship. This way, there's a healthy return on investment from your customer acquisition efforts.

Why is customer acquisition cost important?

Customer acquisition cost is important for your business health several reasons:

Efficiency of customer acquisition.

Understanding customer acquisition cost helps businesses assess how well they're converting leads into customers. A high customer acquisition cost might indicate that marketing and sales efforts aren't optimized, leading to wasted resources.

Profitability for your business.

Ideally, a customer's lifetime value (LTV) should be higher than the customer acquisition cost. This ensures the business makes a profit after acquiring a customer. Analyzing CAC helps businesses determine if their pricing strategy aligns with CAC.

Allocate resources properly.

Understanding which marketing channels has the lowest customer acquisition cost, businesses can districute resources more effectively. This allows them to focus on strategies that bring in customers at a lower cost.

Budgeting and forecasting.

Knowing historical CAC allows businesses to budget for future customer acquisition efforts and forecast how many customers they can acquire with a specific budget.

Making data-driven decisions.

CAC is a key metric that allows businesses to move beyond guesswork in marketing and sales. Businesses can make data-driven decisions to improve their overall customer acquisition strategy by analysing CAC alongside other metrics.

How to calculate customer acquisition cost: The CAC formula.

Customer acquisition cost (CAC) can be calculated with a simple formula that divides the total cost of acquiring new customers by the number of customers acquired within a specific period (month, quarter, year).

Here's a breakdown of the formula's components:

- Marketing + sales expenses: This includes all expenses directly related to acquiring new customers. Examples include salaries for sales and marketing staff, advertising costs, marketing software subscriptions, content creation costs, and even some customer service expenses associated with onboarding new customers.

- Number of new customers: This is the total number of new customers acquired within the chosen time.

For example, money spent by a SaaS company on marketing and total sales efforts during July is $10,000.

During its sales and marketing expenses during the same period, it successfully acquired 100 new customers. The customer acquisition cost is then ($10,000 / 100) or $100.

By calculating CAC, businesses can assess the efficiency of their customer acquisition efforts and make informed decisions about resource allocation and marketing strategies.

What is a good customer acquisition cost (CAC)?

A good customer acquisition cost (CAC) depends on your subscription business model and its specific context.

Ideally, your CAC should be significantly lower than your Customer Lifetime Value (LTV). LTV is the total revenue a customer brings in over their relationship with the business.

A common rule of thumb is to keep CAC around 1/3 or 1/4 of LTV. This means a 3:1 or 4:1 LTV to CAC ratio is good. If your CAC is higher than your LTV, you're losing money on customer acquisition in the long run.

This will give you an estimate of how much revenue you can reasonably expect an average customer to generate for your company throughout their relationship with you.

There are average CACs for different industries. While these are a starting point, your specific CAC might be higher or lower depending on your business model, target market, and marketing strategies.

However, comparing your CAC to industry benchmarks can help you gauge your efficiency.

Imagine CAC as the price of a seed and LTV as the total harvest you get from planting that seed. A good gardener would aim to spend much less on seeds (CAC) compared to the value of their crops (LTV).

CAC benchmarks & comparisons.

Customer Acquisition Cost (CAC) benchmarks are available for different industries.

These benchmarks provide a frame of reference to compare your CAC against the average cost of acquiring a customer within your specific industry.

This comparison helps you understand how efficient your customer acquisition efforts are relative to production costs and to the customer acquisition cost examples your competitors.

It's important to remember that CAC benchmarks are averages, and your actual CAC may vary depending on your business model, target market, and marketing strategies.

However, benchmarks are a valuable tool for identifying areas for improvement and optimizing your customer acquisition strategy.

A study by First Page Sage revealed that CAC vary significantly across industries. On average, it costs businesses to acquire a new customer:

- $702 in the SaaS industry

- $1,450 (the highest) in the fintech industry

- Only $274 (the lowest) in the eCommerce industry

How to improve customer acquisition costs?

CAC is the ratio that represents the return on investment of total sales and marketing efforts relative to new customers gained by implementing them.

Businesses can attract higher-quality leads, improve conversion rates, and reduce the cost of acquiring new customers with these strategies.

Here are some key strategies to improve your CAC:

- Focus on targeted marketing.

Tailoring your marketing efforts to a well-defined target audience helps you avoid wasting resources on unqualified leads. Focus on channels where you can acquire customers.

This could be social media platforms, industry publications, search engine optimization (SEO), or a combination depending on your industry and target market.

- Optimize your sales funnel.

Analyze your sales funnel to identify and address bottlenecks that prevent leads from converting into paying customers.

This might involve optimizing landing pages, streamlining the checkout process, or providing clear calls to action.

Many potential customers abandon websites before making a purchase. Utilize retargeting campaigns to remind these visitors about your offerings and nudge them back into the sales funnel.

- Reduce customer acquisition costs.

Creating valuable and informative content attracts potential customers organically and establishes your brand as an authority.

Happy customers are more likely to become repeat customers and refer your business to others.

Focus on providing excellent customer service and building strong customer relationships. This can significantly your sales and marketing team reduce customer acquisition costs in the long run.

Review your contracts with marketing software providers and other vendors to see if you can negotiate better rates or packages.

Continually test different marketing messages, creatives, and targeting options to see what resonates best with your audience.

- Segment based on customer lifetime value.

Not all customers are created equal. Segmenting your customer base based on LTV allows you to tailor acquisition strategies for high-value segments more customers.

You can invest more resources in acquiring customers with a higher potential lifetime value.

Leverage data and analytics tools to predict which leads are most likely to convert into high-value customers.

This allows you to focus your marketing efforts on the most promising prospects. Typically, CRM software ensures that you can easily manage all customer data in one place and streamline your workflow.

- Improve customer experience.

Providing a seamless and positive customer experience across all touchpoints increases customer satisfaction and loyalty.

Loyal customers with positive customer experience are more likely to repurchase and recommend your business to others, reducing your reliance on paid acquisition channels.

Therefore for customer success, companies must have an open dialogue with their customer base, which can come in the form of cold calling, surveys, post-purchase follow-up emails, and more.

Also, building a strong and recognizable brand can significantly reduce customer acquisition costs in the long run. Customers are more likely to trust and convert to a familiar brand.

A well-designed customer referral program can incentivize existing customers to recommend your product or service to their network. This is a cost-effective way to acquire new customers through trusted sources.

Challenges involved with calculating CAC.

Inaccurate data.

One of the biggest hurdles in calculating CAC is ensuring the accuracy of your data. Gathering reliable information on marketing expenses, sales efforts, and the number of new customers acquired can be trickier than it seems.

Here's why:

Gathering reliable data on things like how much money we’re spending on marketing, how hard our sales team is hustling, and how many new customers we’re bringing in can be a real challenge. Sometimes the numbers are all over the place, making it hard to figure out what’s what.

But here’s the kicker: when our data isn’t accurate, it can mess up our calculations big time. Take Customer Acquisition Cost (CAC) for example. If our data on how much we’re spending to get new customers is off, our CAC calculations will be way off too.

That means we might think we’re doing great when we’re actually spending way more money than we should be to get those new customers.

Conversely, inaccurate data can also overestimate CAC, making your acquisition efforts seem more expensive than they truly are.

Attribution modeling.

Nowadays, customers don’t just stumble upon a product and buy it right away. Nope, they interact with all sorts of stuff—like ads, social media posts, emails—before they finally hit that “buy” button.

Now, here’s where it gets tricky: how do we know which of those touchpoints actually convinced the customer to make the purchase? Was it the Facebook ad they saw first, or the email they got later?

That’s where attribution models swoop in to save the day. These models help us assign credit to different marketing channels based on how much they influenced the customer’s decision.

So, instead of scratching our heads and guessing, we can use these models to get a clearer picture of what’s actually driving those sales.

Attribution modeling might sound like something out of a sci-fi movie, but it’s actually super helpful for us marketers. It helps us understand the true impact of our marketing efforts and make smarter decisions moving forward.

Timeframe considerations.

Okay, so picture this: you’re trying to figure out how much it costs your business to get a new customer. Seems pretty straightforward, right? Well, here’s the twist: deciding on the timeframe for this calculation can be like trying to choose the perfect playlist for a road trip—tricky!

That’s where your business model and customer acquisition cycle come into play. If your business sees a lot of action every month, looking at your CAC monthly might give you a clearer picture.

But if things move a bit slower in your neck of the woods, zooming out to a quarterly or even annual view might be more helpful.

See, it’s not just about picking a timeframe out of a hat. It’s about understanding how your business works and how long it typically takes to reel in those new customers. By choosing the right timeframe, you can get a better grip on your CAC and make smarter decisions for your business.

Next time you’re crunching numbers and trying to figure out how much it costs to bring in those new customers, remember: the timeframe matters!

Customer Acquisition Cost (CAC) is a crucial metric, for any business owner.

It reveals how much you're spending to acquire new customers. Ideally saas business you, you want your CAC lower than your Customer Lifetime Value (LTV), ensuring profitability.

Reducing CAC is an ongoing process. Implementing the strategies mentioned and continually monitoring your results can significantly improve your customer retention and acquisition efficiency.

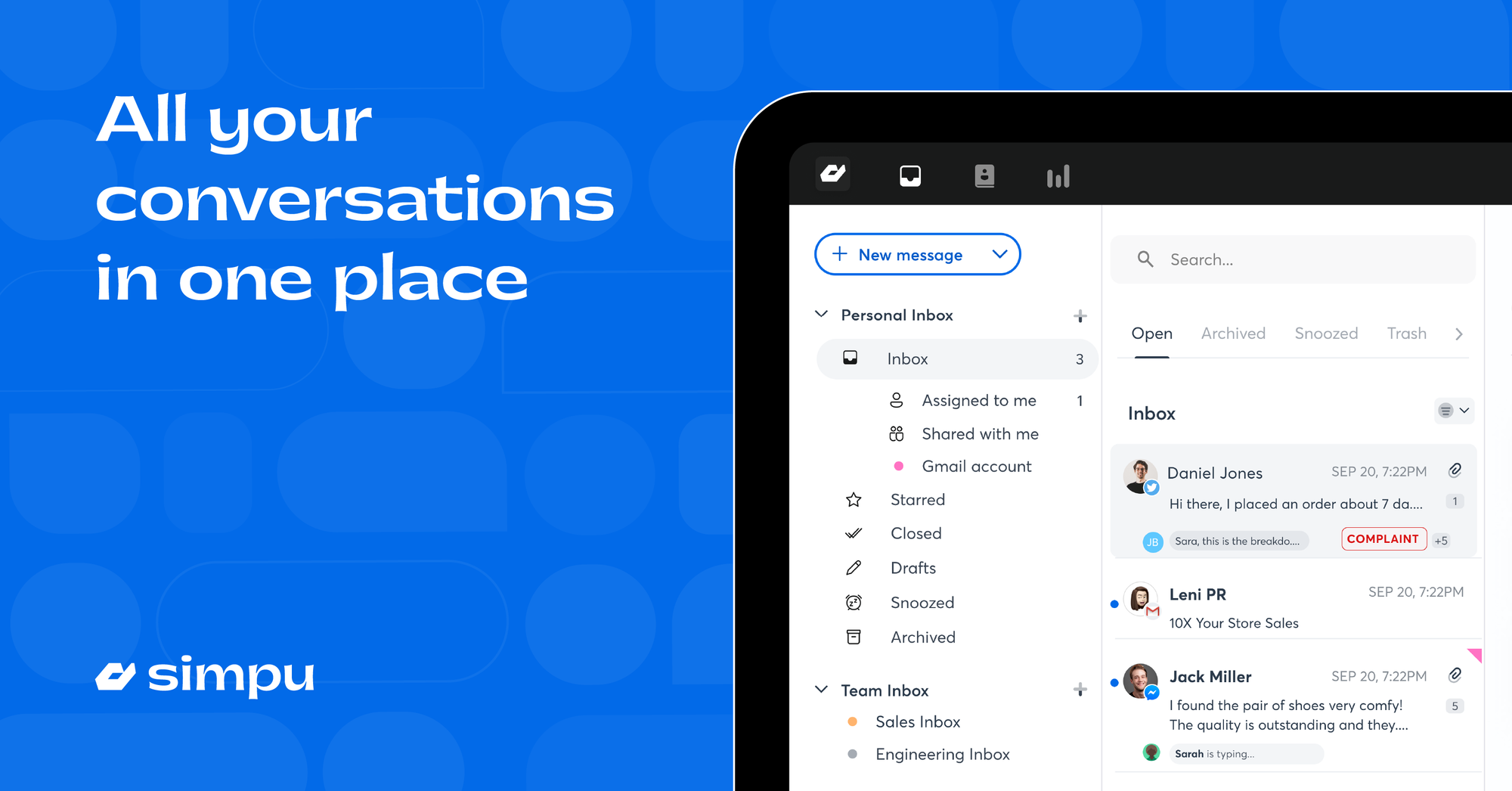

Simpu is an all-in-one communication platform that can streamline customer interactions, boost engagement, and improve customer satisfaction. This translates to higher customer lifetime value and a lower CAC for your business.

Shared Inbox

Connect all your communication channels - email, SMS, Whatsapp, Instagram, Messenger, and Live Chat to one inbox.